By Robert Murphy, Senior Managing Director

Expect M&A Deal Volume in 2022 to Be at Pre-Covid Levels

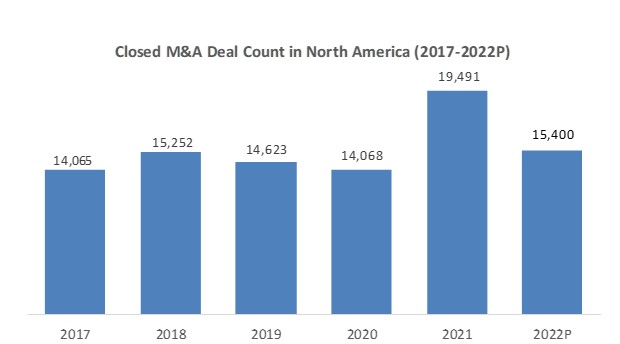

North American merger and acquisition (M&A) deal volumes have declined in each consecutive quarter this year and in each quarter compared with 2021. We are projecting a total deal volume of 15,400 for the 2022 year. This deal level would represent a 20% decline compared to 2021. Pitchbook is estimating private equity (PE) deal volume activity to be down 28.1% in 2022.

One needs to keep in mind that 2021 deal volume was an aberration, driven by fiscal and monetary stimulus, low interest rates, strong public markets and a hangover of 2020 deals related to Covid-19.

The good news is that the projected deal volume of 15,400 is 5.5% above the 2019 level. Deal volume is back at pre-Covid levels, which was considered at the time to be an active M&A market.

While public markets have experienced significant market volatility and lower valuations during the year, private transactions have been less affected. Sectors with recurring revenue, long-term contracts, longer revenue visibility, ability to pass along cost increases or expected to be less impacted during a recession, remain in high demand and garner strong valuations. Examples include healthcare services, industrial services, consumer staples and certain business services.

Source: Pitchbook & PKFIB research.

Rising inflation and interest rates, the Russian-Ukraine war, volatile public markets, and elevated recession risk have negatively impacted deal volume. The effective Fed Funds rate in January was .08% and now stands at 3.08%, a 3-point increase. CPI index rose 8.2% year over year in September and core CPI (excludes energy and food) climbed to 6.6% compared to 6.3% in August.

However, with strong corporate balance sheets and record private equity (PE) dry powder, companies and investors are still very actively looking for investment opportunities despite market volatility and uncertain economic outlook.

Transactions in the lower end of the middle-market ($10m to $100m deal sizes) tend to be less impacted by higher interest rates and public market volatility than larger middle-market deals. This is a result of lower usage of leverage and more stable and moderate valuation multiples.

Source: Pitchbook

*Estimated deal value and deal count as of September 30th, 2022

The Pitchbook (PB) chart above estimates PE deal volume at 6,530 for the 2022 year, a 28.1% decrease from 2021 but a 9.3% increase compared to 2019.

The larger cap deals and larger middle-market deals are more severely impacted by a virtually closed IPO market, challenging loan syndication market and higher interest rates. PE exits have decreased in each consecutive quarter this year and are estimated by PB to decrease by 47.2% this year and by 26.7% compared to 2019 levels.

PE add-ons increased as a proportion of buyout activity in the third quarter reaching a new high of 77.97% of PE buyout activity, per PB. Add-ons scale the PE’s platform increasing revenue, products/services offerings, geographical reach, management depth and create opportunities for cost efficiencies.

Outlook

Continued inflation, market volatility, recession concerns, and increasing interest rates will put increased pressure on valuation multiples and deal activity in the near term, especially, the larger transactions. Industries impacted more severely in a recession will experience sharper declines in deal volumes and valuation multiples.

Industries that can weather a recession and maintain or increase revenue and profits will be in high demand with strong valuation multiples.

Add-on acquisitions will represent a higher percentage of buyout deals due to smaller transaction sizes that are easier to finance and garner lower valuation multiples.

Buyer due diligence and lenders will dig deeper and spend more time on evaluating the sustainability level of earnings going forward. Such evaluation will include supply chain challenges, how the business would perform in a recession, stickiness of revenue, backlog, pipeline and inflation and interest rate impacts on the business.

About PKF Investment Banking

PKF Investment Banking is the investment banking affiliate of PKF O’Connor Davies. Whether a business owner is ready to sell the company or seeking growth through acquisition, our investment banking team is committed and credentialed to help owners achieve their objectives. Our investment bankers provide guidance through every step of the process and bring the expertise to enhance certainty to close – while always staying focused on maximizing the value derived from the transaction.

Securities-related transactions are processed through an unaffiliated broker dealer, Burch & Company, Inc.

PKF O’Connor Davies, LLP is a full-service certified public accounting and advisory firm with a long history of serving clients both domestically and internationally. With roots tracing to 1891, the Firm has 19 offices in the United States and abroad with more than 1400 professionals who provide a complete range of accounting, auditing, tax and management advisory services.

Our Firm provides the information in this e-newsletter for general guidance only, and it does not constitute the provision of legal advice, tax advice, accounting services, or professional consulting of any kind.