Uptick in Q2 M&A Transaction Volume

By Robert Murphy, Senior Managing Director and Alberto Sinesi, Director

For the second quarter, M&A transaction volume in North America after all deals are reported is expected to be 4,300 – a seven percent increase over the average of the prior four quarters. PKF Investment Banking anticipates a three to four percent increase in deal volume for 2024 compared to 2023 and an upward trend over the next six quarters. We attribute this to aging baby boomers contemplating a potential exit scenario and an abundance of available capital, with corporate cash on hand estimated at $4 trillion (Bloomberg) and $1 trillion of accumulated private equity dry powder (2024 US Private Equity Outlook Midyear Update).

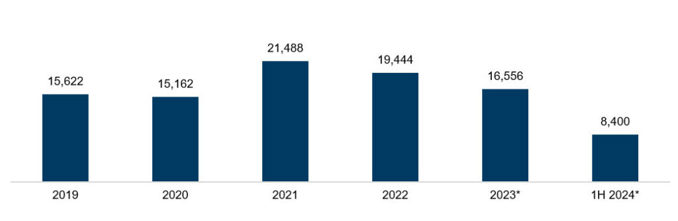

Annual M&A Transaction Volume (Deal Count) in North America

Source: Pitchbook and PKF Investment Banking research

Note: Last two quarters of 2023 and first two quarters of 2024 include estimates based on deals reported through August 31, 2024.

Quarterly M&A Transaction Volume (Deal Count) in North America

Source: Pitchbook and PKF Investment Banking research

Note: Last two quarters of 2023 and first two quarters of 2024 include estimates based on deals reported through August 31, 2024.

Observations for the First Eight Months of 2024

- There is a persistent shortage of high-quality assets in the marketplace.

- High-quality assets are transacting at premiums.

- Scarcity of high-quality assets has caused private equity to move down in transaction size.

- Valuation multiples in the middle market have stabilized after contracting in 2023.

- Valuation gap expectations between buyers and sellers are narrowing.

- Private equity add-on activity remains robust.

- Increasing optimism for a strong 2025 M&A market.

Industry Sectors in Demand

The table below provides an illustrative list (not a complete list) of industry sectors that have witnessed resilient M&A activity and healthy valuation multiples. Sectors in favor include companies with strong end markets, tangible growth opportunities, visibility of earnings, consolidation strategy and attractive cash flow and margin profile.

|

Select Sectors Observing Resilient Activity |

|

Favorable Business/Sector Characteristics |

| Tech-enabled health care and business services | Recurring purchasing pattern/revenue visibility | |

| Financial services/fintech/insurance | Solid cash flow profile vs. growth at all costs | |

| SaaS | Sticky customer/vendor relationships | |

| Value-added distribution | Functional nature of products/services | |

| Automotive aftermarket/services | Premium brand positioning | |

| HVAC/landscaping/roofing services | Efficient operations mitigating supply chain issues | |

| Pet services/foods | Defensible segments even during a downturn | |

| Better-for-you foods/health and wellness products | Fragmented spaces ripe for consolidation | |

| Frozen foods/ethnic foods | Underlying secular trends with strong tailwinds |

Looking Forward

We expect that our next update in January 2025, after the election and with expected rate reductions over the coming months, will have a very positive outlook for both deal activity and valuation multiples in 2025.