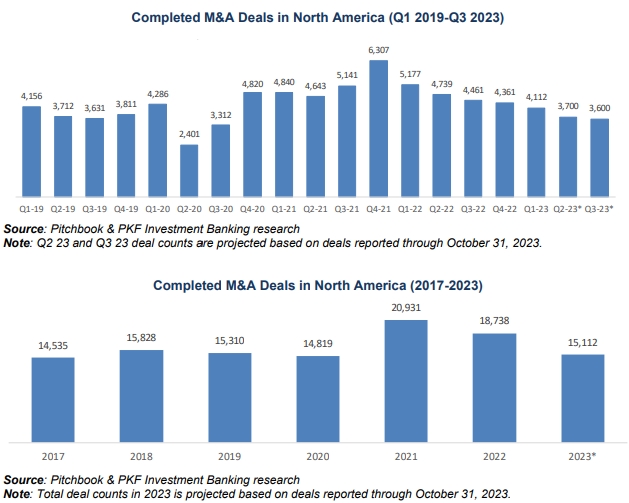

M&A Deal Activity Stabilizing in Second Half 2023

The decrease in North American M&A deal count has shown signs of slowing down, as illustrated in the chart below. After six consecutive quarters of consistent decline following the peak in Q4 2021, the rate of decrease in deal count appears to be moderating. PKF Investment Banking estimates M&A deal activity stabilizing in the second half of 2023. We expect Q4 to be similar to Q2 and Q3 levels of 3,600 – 3,700. It is important to highlight that the North American M&A deal count in 2023 is projected to approach the preCOVID levels seen in 2018 and 2019, both of which were considered strong M&A markets.

The decline in activity in 2022 and 2023 can be attributed to several factors: higher interest rates, recessionary fears, persistent inflation, tightened credit markets, geopolitical uncertainties and a dislocation in buyer/seller value expectations across various sectors.

The lower middle market (LMM) with deal sizes ranging from $10 million to $250 million is less impacted by interest rates and tightening debt markets. This is due to more moderate leverage levels associated with these deal sizes, and many of the LMM deals involve add-on acquisitions. While LMM activity has benefited from an increased focus on add-ons by PE, it has not been immune to the headwinds mentioned above.

A Pause in Interest Rate Hikes Reduced Upward Pressure on Borrowing Costs

The Federal Reserve’s decision to maintain the rates steady at 5.25-5.50% during its September 19-20, 2023, FOMC meeting marked a temporary break from the previously aggressive rate-hiking campaign initiated in March 2022 to combat inflation. This pause, expected by the market, provided relief by easing the upward pressure on borrowing costs, a key challenge for dealmaking. It’s worth noting, however, that the Federal Reserve has indicated the possibility of another rate increase beyond the current 5.25% to 5.50% range. This reflects the central bank’s ongoing effort to balance inflation control with support for economic growth and stability.

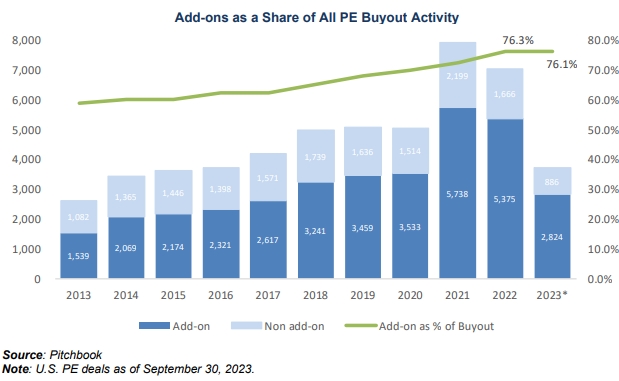

PE Platform Activity Continued to Decline while Add-on Activity Remained Steady

According to Pitchbook, platform deals declined by 20.6% in value from the prior quarter and 42.9% YTD. Higher debt financing costs and contracting leverage ratios remain challenges to platform deals.

On the other hand, add-on deals, with much smaller deal sizes and lower reliance on new debt, have consistently represented over 70% of all buyouts. Pitchbook reports that add-ons have reached a near record high share of all PE buyouts at 76.1% YTD.

With $1.4 trillion in unspent dry powder, PE firms are utilizing add-on opportunities to deploy their capital while awaiting a more favorable environment for platform acquisitions.

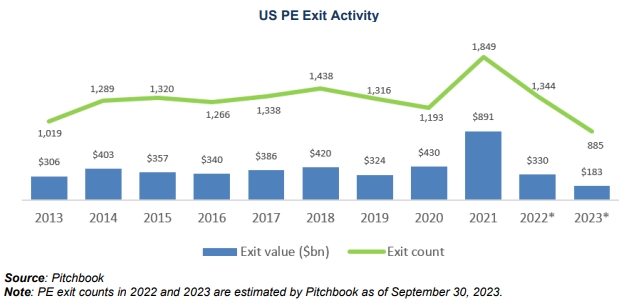

M&A Transaction Backlogs and PE Exits Are Waiting for Market Resurgence

The deceleration of M&A activities since 2022 has led to a backlog of M&A transactions waiting to go to market. Concurrently, the PE exit markets have continuously shown signs of a downturn. According to data from Pitchbook, Q3 saw a total of 275 PE-backed companies exiting the market, accumulating an exit value of $44.1 billion. This marks a decline of 6.9% and 40.7% on a quarterly basis, respectively.

Factors such as economic uncertainty, a challenging lending environment and valuation volatility have dampened the enthusiasm of PE firms for pursuing new deals. Instead, they are increasingly inclined to extend their ownership of portfolio companies. Chiefexecutive.net reports that the median holding periods of PE-backed portfolio companies have reached historical lengths, now standing at 5.6 years, the longest duration observed in over two decades.

As the economic landscape stabilizes and financing dynamics improve, accumulated M&A backlogs, particularly those comprising PE-backed portfolio companies, are poised to offer a pool of attractive assets for prospective investors.

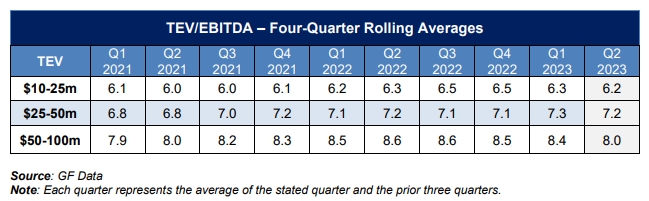

Valuation Compression in 2023

Recessionary fears, disappointing company performance, higher borrowing costs and a tighter lending environment have collectively pushed down valuation multiples across the board. However, the shift in valuation multiples varies significantly across industry sectors and individual company performances. A flight to quality by investors continues. Companies demonstrating robust operating performance in sectors better equipped to withstand a recession continue to experience strong valuation multiples.

The chart below illustrates TEV/EBITDA multiples categorized by TEV tier on a rolling four-quarter basis.

The lower end of the LMM has shown more resilience in terms of valuation multiples. PE firms remain highly active in pursuing add-on acquisitions to grow their platforms. Additionally, lower debt leverage is utilized in these deal sizes, and there is less of a valuation disconnect between buyers and sellers, as deals in the LMM tend to transact within a tighter multiple range. It is worth highlighting the noticeable increase in the utilization of earnouts and seller notes to help bridge the valuation gap.

Outlook – Near Term Stable Activity Level with Moderate Increase Later in 2024

In the coming quarters, we anticipate stable activity levels in the M&A market for Q4 2023 and Q1 2024, with the expectation of a gradual increase in activity during 2024. Several compelling near-term drivers could stimulate M&A activity:

- Moderating Interest Rates. Private equity activity is expected to increase as interest rates in North America stabilize and eventually decline. Lower interest rates will make financing more attractive and accessible leading to a resurgence in deal-making, especially LBOs within the PE sector.

- Record-Level Dry Powder. With substantial funds on hand, PE firms are under pressure to seek out viable investment opportunities rather than letting their raised capital remain idle for extended periods.

- Valuation Convergence. The narrowing gap in valuation between potential buyers and sellers is likely to facilitate more fruitful negotiations and bring both parties back to the table, spurring increased M&A transactions.

- Sizable Deal Backlog. A backlog of M&A deals, combined with an abundance of exit opportunities for PE-backed firms, is expected to create a wealth of investment prospects. We believe sponsors will adopt a more assertive stance in deploying capital to close out existing funds and to capitalize on portfolio company realizations, which will support future fundraising efforts.

While we acknowledge the existing challenges, these key drivers offer reasons for optimism within the M&A landscape as we navigate through the uncertainties of the coming quarters. For pdf version click here.

Contact Us

Robert Murphy

Senior Managing Director

PKF Investment Banking

rmurphy@pkfib.com | 561.337.5324

Susan Zhang

Vice President

PKF Investment Banking

szhang@pkfib.com | 201.639.5739

About PKF Investment Banking

PKF O’Connor Davies Capital LLC (DBA PKF Investment Banking) is the investment banking affiliate of PKF O’Connor Davies. PKF O’Connor Davies Advisory LLC is a member firm of the PKF International Limited network of legally independent firms and does not accept any responsibility or liability for the actions or inactions on the part of any other individual member firm or firms.

The PKF Investment Banking team has completed over 250 M&A advisory and capital raise engagements in North America and abroad. Companies and business owners across a range of industries rely on our transaction and sector expertise, global reach, confidentiality and utmost integrity to help them achieve their objectives. We focus on privately held companies and have extensive knowledge with decades of experience advising middle-market businesses. Our key services include sell-side and buy-side M&A advisory, exit readiness and transaction planning.

Disclaimer

PKF Investment Banking provides this report for information purposes only and it does not constitute the provision of financial, legal or tax advice or accounting or professional consulting services of any kind. Securities-related transactions are processed through an unaffiliated broker-dealer, Burch & Company, Inc.